Personal Injury Settlement Offers: When to Negotiate vs Accept

Whether you were injured in a car crash, slip and fall, or any other personal injury claim, you deserve a settlement that covers your expenses. Dealing with insurance companies while you’re recovering can feel overwhelming and leave you desperate for any funds. But the first settlement offer isn’t always the best. If an offer is too low to cover your necessary expenses, it could be worth negotiating for a higher personal injury settlement.

Below, learn when to settle and when to ask for more, based on insights from a Providence personal injury lawyer.

What is a Personal Injury Settlement Offer?

In the world of personal injury claims, a settlement offer can refer to one of two things:

- In an insurance claim, a settlement offer comes from the insurance company as an attempt to resolve the claim.

- In a lawsuit: In lawsuits, a settlement offer is a potential agreement from one party to another, offering a set amount of funds to prevent the lawsuit from going to trial.

In many personal injury cases, it’s common to file a claim with an insurance company first and only escalate to a lawsuit if you can’t reach an agreement.

Remember that accepting a settlement offer is final. So, you need to verify that the offer is fair and right for your circumstances. If the first offer isn’t a good fit, it’s possible to negotiate a settlement that will benefit you, both directly with insurance companies and during a lawsuit.

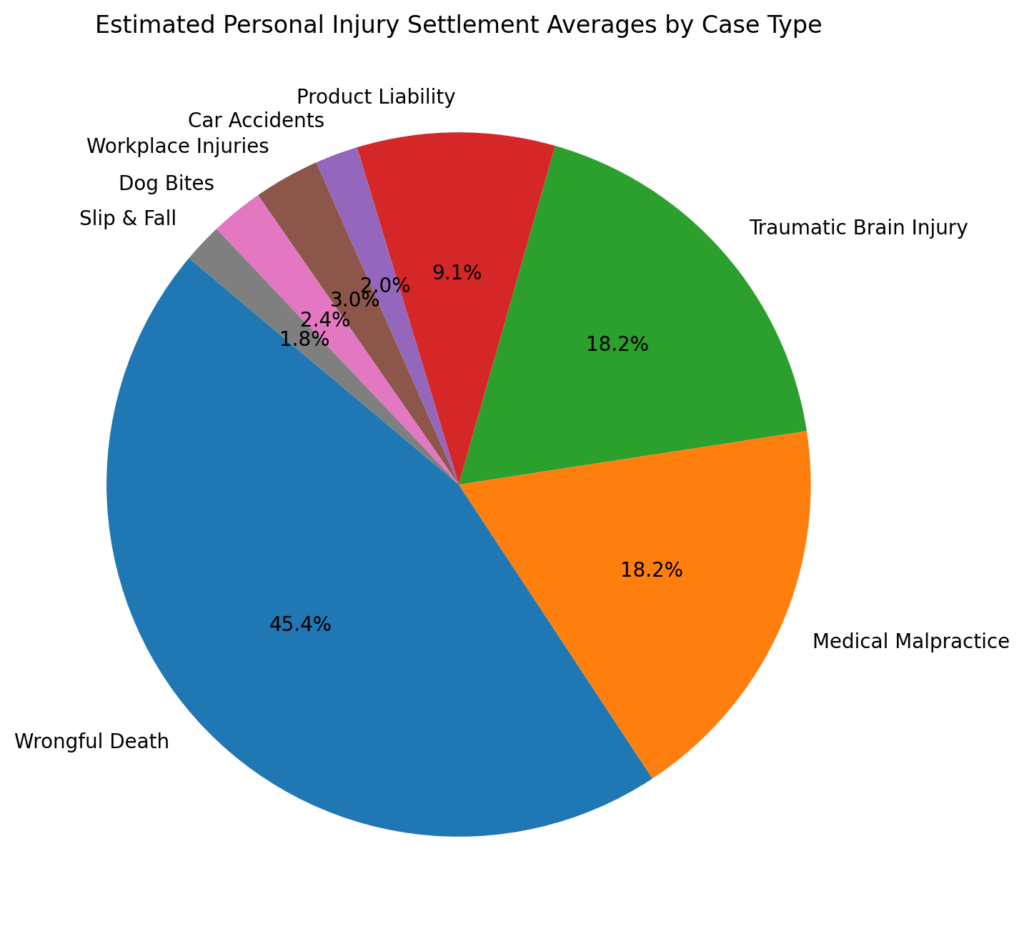

What’s the Average Settlement Offer for Personal Injury Claims?

Since most personal injury settlement offers are private, and every injury and case has variables, it’s hard to collect data on average amounts. An experienced Providence personal injury lawyer can help you understand the normal range they usually see for similar cases, helping you determine what to aim for.

What is a Good Settlement Offer?

When evaluating a settlement offer, you and your lawyer should consider factors specific to your situation, like the extent of your injuries and any future expenses you may need. Your lawyer help you understand what factors you can realistically pursue with the facts of your case.

You can feel comfortable settling if all of the following factors are met.

- Covers all your injury-related expenses. Personal injury victims deserve a settlement that covers both economic damages, such as medical bills, and emotional ones, like a loss in quality of life. A good settlement offer should take all of these factors into account and offer an appropriate sum.

- It covers future expenses. Some injuries may require ongoing care, even after the initial hospital stay. So, a good settlement offer should allot for future costs, like ongoing doctors’ visits.

- Honors policy limits. When dealing with an insurance company, a settlement offer that meets or comes close to the policy limit ensures that nothing is “left on the table,” and offers you peace of mind.

When to Settle

How can you tell whether to approve of an insurance settlement offer letter? If the following factors apply to you, your lawyer may recommend accepting the settlement.

- You have clear evidence of fault. It’s a common tactic for both insurance companies and parties in a lawsuit to dispute fault. But if you have clear evidence of one person’s wrongdoing, such as a dashcam video of a car crash, you’re often more likely to get a reasonable settlement offer.

- No future damages. If you don’t anticipate any ongoing medical bills or pain and suffering, accepting a one-time settlement can help you cover your existing expenses and get your life back on track.

- You want to avoid a trial. In a lawsuit, going to trial is often unpredictable. There’s always a risk of ending up with less than your initial settlement offer. If you want to avoid drawing out the case or don’t want to take the risk, settling can be a safer choice.

When to Negotiate a Settlement

On the other hand, not every settlement offer will meet all your criteria, especially those made early in negotiations. If any of the following factors ring true, it may be worth staying firm and negotiating.

- The insurance policy covers more. In insurance negotiations, a company might first offer less than what the policy will cover. If it’s significantly less, negotiating for the full amount is often worth the time.

- You have more evidence. Sometimes, insurance companies offer low settlements by underestimating the extent of your injuries. If you can provide clear medical evidence, you may get a higher settlement offer.

- It doesn’t include non-economic damages. Especially severe injuries can scar you emotionally or damage your quality of life. If an insurance offer only takes the physical toll into account, it may be worth pushing for pain and suffering damages.

How to Respond to a Low Settlement Offer

Insurance claims adjusters may come out with a low settlement offer at first, but you don’t need to feel pressured to accept their initial offer

Instead, you can reject the offer with a letter, stating calmly yet firmly why the initial offer is too low. If you can include additional evidence to reinforce your claim, like pictures of your injuries or screenshots of medical records, now is a perfect time to include them. You can also quote a counteroffer that you feel is more reasonable.

You can see more settlement negotiation tips in our blog: How to negotiate with insurance companies.

Work With a Providence Personal Injury Lawyer to Get a Settlement

If you need help negotiating a personal injury settlement that’s right for you, Petrarca Law is here for you.

We’ll fight aggressively to get the funds you deserve, whether you’re navigating claims or filing a lawsuit. We handle all the paperwork and tedious negotiations for you. So, you can focus on healing while your legal team works towards a settlement you feel good about accepting.

Contact us today for an obligation-free consultation with your Providence personal injury lawyers.