Employer’s Responsibilities under RI Workers’ Compensation Law

RI workers compensation is a type of insurance that protects employees who are injured or disabled in work-related incidents. In Rhode Island, every business with one or more employees must carry workers’ compensation coverage and meet other requirements in the event of an injury. Failing to do so can result in fines, forced closure, and even jail time.

How does workers’ compensation work?

Workers’ compensation coverage is “no-fault,” meaning that employees can receive benefits regardless of who is “at fault” for their injury. In other words, even if the incident was partly your fault, you can still get workers’ compensation benefits.

Workers’ comp also protects employers from liability, meaning that you waive the right to sue them when you file a claim. That said, employers must also adhere to specific requirements to remain compliant with Rhode Island law.

What are workers’ comp employer’s responsibilities in Rhode Island?

In Rhode Island, any business that employs one or more employees must carry workers’ compensation. The only exceptions include businesses in the following sectors:

- Agricultural

- Domestic service

- Real estate

- Police and firefighters

- Federal employers

Employers that don’t carry the required workers’ compensation insurance can face penalties, including:

- Fines of $1,000 per day that the business operated without insurance

- Business closure

- A felony charge with a $10,000 fine and up to two years in prison upon conviction

Employer reporting requirements

Employers are required to report workplace injuries to the insurance carrier within 10 days of the incident date or 10 days from the date they learned of the injury. Failing to do so can result in a $250 penalty.

Employers must report all workplace-related injuries that meet the following criteria:

- The injury requires medical treatment.

- The employee can’t work for more than 3 days.

- The employee dies

The employee is not permitted to complete their own initial report. The employer can either use a First Report of Injury form provided by the Rhode Island Department of Labor and Training (RIDLT) or create an internal form.

Right to reinstatement

Rhode Island workers’ compensation law includes a “right to reinstatement.” If an employee is not fully disabled and can still perform the basic tasks of their previous position, the employer must reinstate them upon request.

The right to reinstatement only applies to businesses with nine or more employees. There are also a few types of employees who aren’t covered by the right to reinstatement, which include:

- Temporary or seasonal workers

- Employees hired from a union hiring hall

- Workers who are on a probationary period of under 91 days

Continued benefits

If the employee can’t return to work right away, employers must continue to provide health insurance coverage up to two years after the beginning of their workers’ comp benefits.

However, employers who fall under the federal Employee Retirement Income Security Act (ERISA) don’t need to follow these rules. You can see if your employer falls under ERISA on the U.S. Department of Labor’s website.

Disclosure and certificates

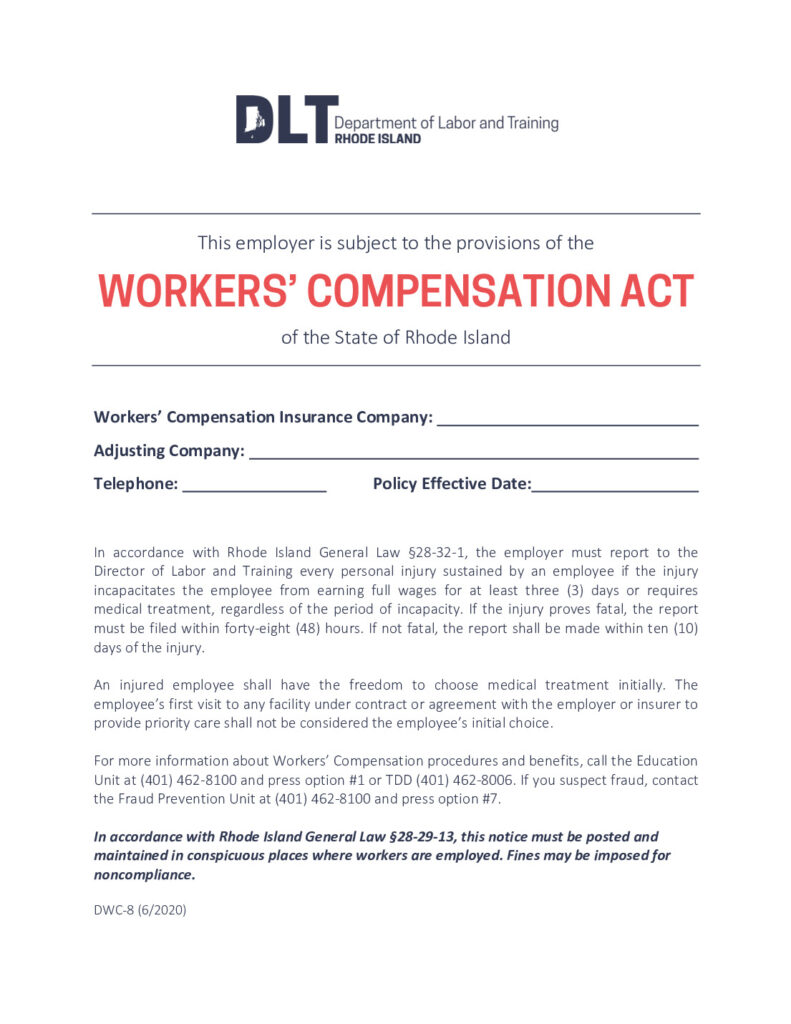

Employers must provide employees with information about their RI workers’ compensation coverage and rights. For example, your employer is required to display a Workers’ Compensation Act poster, which should include general information on workers’ comp law and the name of the insurance carrier.

All businesses with workers’ comp insurance must also file for an annual certificate of compliance.

Correct employee classification

Employers must correctly classify employees and provide the required workers’ compensation benefits to those who qualify. Incorrectly classifying an employee as an independent contractor can result in civil penalties and potentially lead to criminal charges under the federal Fair Labor Standards Act.

For example, first-time misclassification offenses can result in fines of $1,500 to $ 3,000 per employee, and up to $5,000 per employee for any subsequent offenses.

Can RI employers be guilty of workers’ compensation fraud?

Yes. Employers who willfully misrepresent or don’t disclose certain information to insurers can be held accountable in Rhode Island’s Workers’ Compensation Court. Examples of other offenses that constitute employer fraud include:

- Making false statements to deny workers’ comp benefits

- Failing to report employee earnings during the benefit payment period

- Knowingly making false statements about an employee’s right to coverage

- Coercing an employee to willfully misrepresent their employment status

Employers who are found guilty of workers’ compensation fraud can face penalties including:

- A fine of up to $50,000 or double the fraud

- Up to 5 years imprisonment

What if my employer broke the rules?

If you believe that your employer didn’t meet their responsibilities under Rhode Island workers’ compensation law, you can file a report on the RIDLT’s website.

If you aren’t sure whether or not your employer violated the law, it’s a good idea to contact a Rhode Island workers’ comp lawyer. A lawyer can help you understand your rights and determine if your employer fulfilled their obligations. They can also help you understand whether or not you’re incorrectly classified as an independent contractor and missing out on workers’ comp coverage and other benefits.

An RI workers’ comp attorney you can trust

If you need help navigating your rights to workers’ comp coverage, Petrarca Law will fight for you. We can negotiate with insurance companies on your behalf to get you the workers’ comp settlement you deserve. If your employer broke the rules, we can advise you on the best path toward justice, so you and your fellow employees can take full advantage of your benefits. Contact our offices today to schedule a free consultation.