What To Do If You’re Injured In A Rideshare Accident in Rhode Island

Rideshare services like Uber and Lyft provide a convenient way to get around Rhode Island. However, when you suffer injuries in a rideshare accident, filing an insurance claim can be confusing. Thankfully, these companies are required to have policies for rideshare insurance to cover such cases.

Below, learn more about what comes after a rideshare accident, courtesy of an experienced Rhode Island personal injury lawyer.

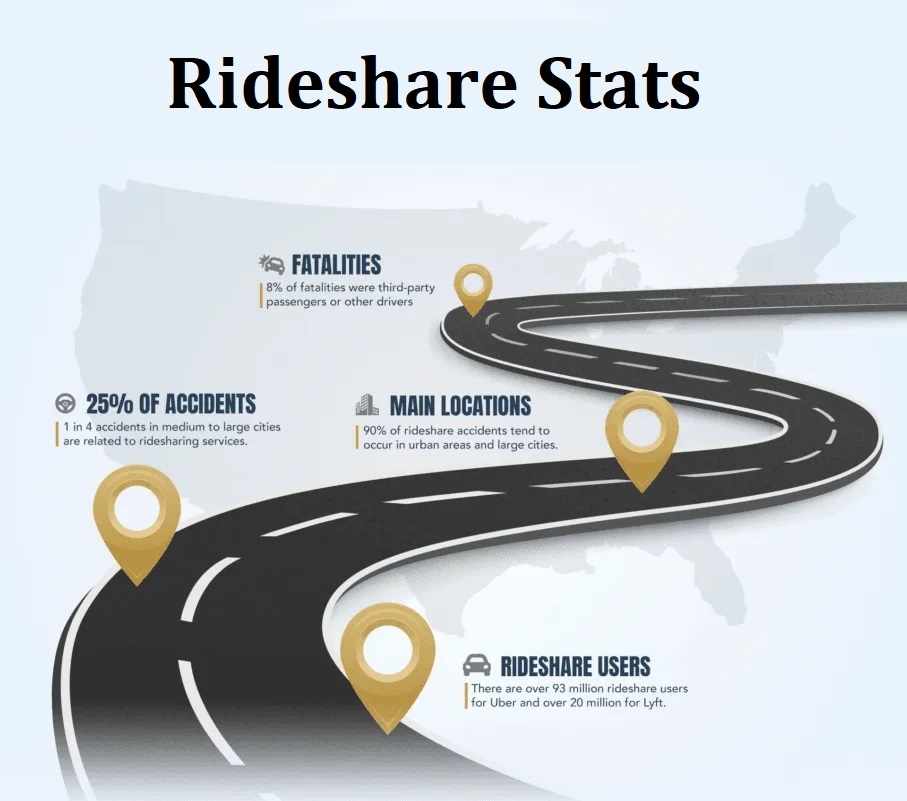

Rideshare Accident Statistics

Rideshare statistics indicate that rideshare services can reduce alcohol-related traffic fatalities, since they offer a convenient mode of transportation after a night out. However, Uber and Lyft drivers aren’t immune to causing accidents. Like all of us, they can drive distracted, drowsy, or recklessly.

Key statistics for rideshare-related accidents include the following.

- Worldwide, Uber accounted for nearly 10 billion vehicle trips in 2023 alone.

- Rideshare services account for up to 13% of all vehicle traffic in some US cities.

- According to 2021 data from the Centers for Disease Control and Prevention (CDC), for every 100 rideshare trips in a New York City taxi zone, the likelihood of injury-causing crashes increases by 4.6%.

- A 2024 survey by the University of Illinois researchers found that one-third of surveyed rideshare drivers had a crash while working.

- Between 2017 and 2018, nearly 20% of fatal crashes involving Uber were due to the Uber driver’s actions.

Is Rhode Island a No-Fault State?

No. Rhode Island is an at-fault state. This means that if a crash results in injuries or illnesses, the driver who is primarily responsible must cover expenses through their insurance coverage. That’s true even if the driver works with a rideshare company.

Is Uber Responsible for Accidents in Rhode Island?

Under Rhode Island law, Uber and Lyft are considered transportation network companies (TNCs), not taxi companies. Under this principle, rideshare drivers are considered third-party contractors rather than employees of the parent company, which means that Uber or Lyft generally can’t be held liable if a driver causes a crash.

However, Rhode Island law requires that every vehicle driving for a TNC carry “adequate” insurance coverage for injuries and property damage. Uber and Lyft both connect drivers with third-party insurance companies that meet these requirements.

What Does Rdeshare Insurance Cover in Rhode Island?

In Rhode Island, anyone using a personal vehicle to drive for a rideshare company must have an insurance policy that meets stricter requirements than usual. The policy requirements differ slightly, depending on whether or not the driver is actively transporting a passenger.

When logged into the app, but not actively transporting a passenger, the driver’s insurance policy must meet the following requirements.

- $50,000 for death and bodily injury per person

- $100,000 for death and bodily injury per incident

- $25,000 for property damage.

When transporting a passenger, the driver’s liability coverage must meet the following requirements.

- $1,500,000 total liability coverage for death, bodily injury, and property damage.

Both policies require uninsured (UM) and underinsured motorist coverage (UIM).

How Does Rideshare Insurance Coverage Affect Claims?

In practice, this means that the insurance coverage limits depend on whether or not the driver was transporting a passenger.

For example, suppose you’re struck by an Uber driver who was checking their phone but didn’t have a passenger in the car. In that case, you’ll deal with their non-passenger insurance policy, which covers up to $50,000 in personal injury coverage.

Meanwhile, if the driver had passengers in the car at the time of the crash, you’ll deal with the policy that offers up to $1.5 million in liability coverage.

What if I’m Injured as a Passenger in a Rideshare Accident?

If you’re injured while riding in a rideshare driver’s vehicle, and the accident is the rideshare driver’s fault, you should generally be able to file under the driver’s insurance policy.

If another driver caused the accident rather than the rideshare driver, you’ll typically file with that driver’s insurance company. If the third-party driver doesn’t have insurance or doesn’t have a policy that covers your medical expenses, you may be able to file with the rideshare driver’s UIM/UIM policy.

Shared Fault in a Rideshare Accident

Of course, “fault” isn’t always cut and dry after an accident, further complicating insurance claims. For example, perhaps the Uber driver was checking their phone, but the driver of the other vehicle was speeding. In scenarios like these, Rhode Island has a legal rule called “pure comparative negligence” that effectively “splits” fault between both parties. For example, if the Uber Driver was 80% responsible for the crash, their insurance company is then responsible for 80% of your crash-related expenses.

Negotiating With a Rideshare Insurance Company

Just because a driver’s policy is supposed to cover your medical bills, that doesn’t mean the insurance company will settle easily. The insurance company may downplay the rideshare driver’s role in the accident or devalue the extent of your injuries. Instead of grappling with an insurance company on your own, a RI car accident lawyer can negotiate on your behalf and help you get the maximum settlement amount.

Find the Rhode Island Lawyer You Need for a Rideshare Accident

If you suffered injuries in a rideshare accident, trust Petrarca Law to get the settlement you deserve.

As Providence personal injury lawyers with over 40 years of combined experience, we’ve successfully stood up to large insurance companies on behalf of our clients, and we won’t rest until you get the funds you’re legally entitled to.

Contact us today for a free consultation of your case.